SPECIAL PRICING: A sheer value proposition with a price tag starting from Rs 11,000 (Rs 2,000 for RMP Exam only)

Risk Management is a growing specialisation that is integrating across almost all business function. Internal Audit remains at the Core of Risk Mitigation efforts. Besides internal audit, Compliance, Information Security, IT Governance, Corporate Governance, Finance all benefit from the effectiveness of Risk Management. Risk Management Certification in India and Risk Management Courses in India are not many. Educational Institutes are catching up to this requirement. A few that exist provide mostly Financial Risk Management courses. At Riskpro, we want to offer a broad based Risk Management Certification that ensures that a wider audience is able to benefit from this program. This is a self paced Online / interactive learning that is customised to bring the latest developments to the users.

The need for Risk Management Certification:

- Risk Management weakness is often highlighted as the core of all financial crisis. Every major event and fraud is a lapse in Risk Management

- Risk Management adds value to an organisation in the long term and in a sustained manner

- Training in Risk Management is often not present in current University and MBA syllabus.

- Risk Managers are often sought and well paid. These professionals are likely to play a major role in strategy implementation of any organization in the future

Riskpro Offering

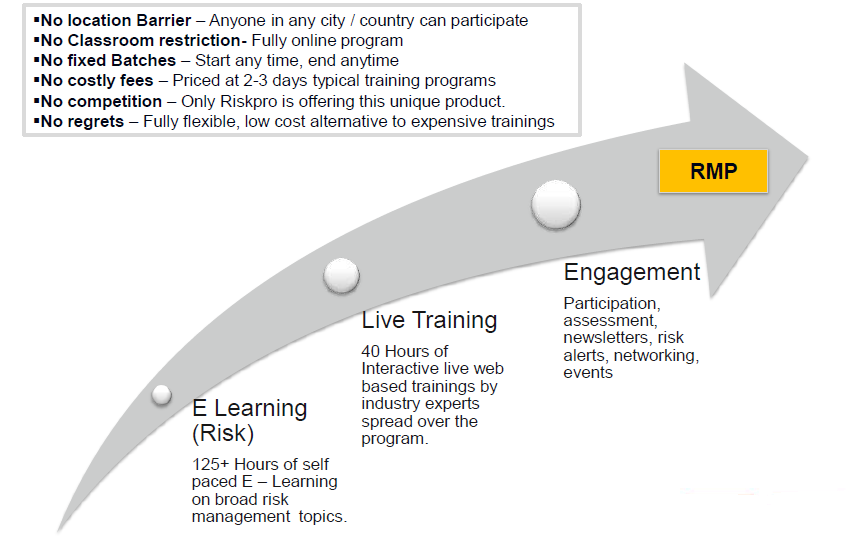

- Riskpro introduces a unique Certification in Risk Management titled Risk Management Professional(RMP)

- RMP coves all aspects of risk management and not just focused on Banking Risk, Financial Risk. We believe that risk management is a holistic concept, not just restricted to banking/Insurance

- Just imagine almost 200 hours of risk related training, practical training, webinars, counseling, regular risk updates. You are constantly being exposed to risk management and will surely make you a true and well informed risk manager.

Download RMP Risk Certification Brochure

Alternatively, for more information, please email manoj.jain@riskpro.inView Demo on the RMP Course and a Video on the RMP Program features. (Click on youtube videos on right hand side menuSample - RMP users are employed with following companiesStill Reading.... Read on to learn more on the programWith approximately 200 Hours of learning, this programs gives you a value at the rate of Rs 90/hour of learning. Where else would you get risk management training (structured training with quiz, case studies and international standards) at this rate.

The course content is given below.

Subject Topic

Market Risk : Basic Level

1. Interest Rate Risk

2. Liquidity Risk

3. Equity Risk

4. Portfolio Risk

5. Foreign Exchange Risk

6. Commodity Risk

7. Regulatory Issues

8. Value at RiskBasics of Finance / Banking : Financial Mathematics

9. Bond Pricing

10. Probability Distributions and their Properties

11. Measuring Volatility

12. Correlation and Regression AnalysisGovernance : Global Banking Supervision

13. Core Principles and Methodology

14. Supervisory Self-Assessment

15. Corporate Governance in Banks

16. Internal Control System

17. Internal Audit in Banks

18. Supervisors and External Auditors

19. Operational Risk Management

20. Liquidity Management

21. Credit Risk Management

22. Management of Settlement Risk in Foreign Exchange

23. Trading and Derivatives Activities

24. Risk Management Principles for E-banking

25. Loan Accounting and Disclosure

26. Highly Leveraged Institutions

27. Dealing with weak banksBasel II University

28. Basel II - An Overview

29. Scope of Application

30. Credit Risk - Standardized Approach

31. Standardized Approach - Credit Risk Mitigation

32. Simplified Standardized Approach

33. IRB Approach - Overview

34. IRB Approach - Rules for Exposures

35. IRB Approach - Minimum Requirements

36. Credit Risk - Securitization Framework

37. Operation Risk Measurement Approaches

38. Qualifying Criteria for Operational Risk

39. Market Risk - Measurement Framework

40. Market Risk - Standardized Measurement Approach

41. Market Risk - Internal Models Approach

42. Key Principles

43. Specific Issues

44. Supervisory Review Process for Securitization

45. Market DisciplineCounterparty Credit Risk

46. Overview to Derivative Products-I

47. Overview to Derivative Products-II

48. Credit Exposure

49. Credit Risk in Derivative Products

50. Pre-settlement & Settlement Risk

51. Netting

52. Margin and Collateral Requirements

53. Monte Carlo Simulation

54. Case StudiesOperational Risk Management

55. Introduction to Operational Risk

56. Basic Concepts

57. Regulatory Treatment of Operational Risk under Basel-II

58. Operational Risk in Various Banking Sectors

59. Operational Risk in insurance

60. Developing objectives and identifying risks

61. Estimating potential losses – Data

62. Estimating potential losses – Loss distributions

63. Analyzing risks

64. Loss prediction and prevention

65. Loss control

66. Loss reduction and risk avoidance

67. Risk financing

68. Measurement framework

69. ORM in practice

70. Enterprise-wide Risk Management (ERM)

71. Basic and causal models

72. Legal risk and taxation rules

73. E-banking

74. Systems and software

75. Case study - BaringsAnti-Money Laundering / Know-Your-Client

76. What Is Money Laundering

77. International Initiatives

78. Customer Identification Program

79. USA Patriot Act

80. Wolfberg’s principles on correspondent banking

81. Terrorist related money laundering

82. Know your CustomerCorporate Governance

83. Overview

84. Models and Mechanisms

85. Shareholders and Stakeholders

86. Board of Directors

87. Audit Committee

88. Banking Corporate Governance

89. Corporate Scandals

90. Best Practices

91. Corporate ResponsibilityForeign Exchange Markets

92. Overview of Foreign Exchange Market

93. Spot Market

94. Forward Market

95. Determination of Exchange Rates

96. Currency Futures

97. Currency Options

98. Currency Swaps

99. Second Generation Forward Contracts

100. FX Trading ControlsSarbanes Oxley Act

101. Overview of Sarbanes-Oxley Act

102. Public Company Accounting Oversight Board

103. Auditor Independence

104. Corporate Responsibility

105. Enhanced Financial Disclosures

106. Analyst Conflicts of Interest

107. Commission Resources and Authority

108. Studies and Reports

109. Corporate and Criminal Fraud Accountability

110. White-Collar Crime Penalty Enhancements

111. Corporate Tax Returns

112. Corporate Fraud and AccountabilityTechnology and Security Risk

113. Internal Control in Banks

114. Banking Technology

115. Branch Security

116. Branch Security - Fraud AspectsGovernance, Risk & Compliance

117. Classification of Risks

118. Introduction to ERM and its Frameworks

119. Regulatory Landscape

120. Governance, Risk and Compliance - Demystified

121. COSO and CobiT in Support of GRC Needs

122. Operational Risk Management Primer

123. GRC - Case StudyTrading Operation Controls

124. Trade Life Cycle

125. Front Office Controls

126. Middle Office Controls

127. Back Office ControlsGeneral Risks and Analytics

128. Industry Risk

129. Business Risks

130. Financial Risks

131. Management Risks

132. Project RisksInsurance Risks

133. Insurance Concepts

134. Analysis and Evaluation of Risk Exposure

135. Actuarial Principles